Quickr – IPO

Once one of India’s early unicorns, horizontal classifieds platform Quikr has experienced a consistent year-on-year decline in revenue and is now barely clinging to survival, operating at a drastically reduced scale. While the Bengaluru-based company reported a 12% drop in operating revenue, the silver lining is that it turned profitable for the first time, achieving a profit-to-revenue ratio of 1:22 in the fiscal year ending March 2024. Is that the start of a turnaround? Perish the thought.

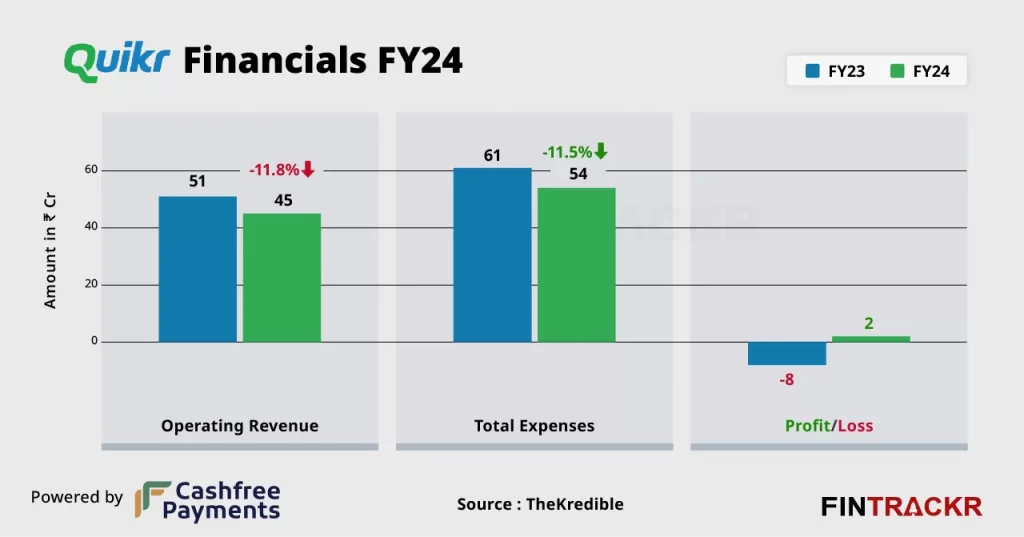

Quikr’s revenue from operations dropped 12% to Rs 45 crore in FY24 from Rs 51 crore in FY23, according to its consolidated financial statement sourced from the Registrar of Companies (RoC).

The bulk of Quikr’s revenue, accounting for 86% of total income, came from lead referral fees and advertising. Lead referral fees generated Rs 22 crore, while advertising services brought in Rs 17 crore. Commission and other service income contributed Rs 3 crore each.

The firm earned an additional Rs 11 crore from provision write-backs and gains on financial assets, taking its total income to Rs 56 crore in FY24.

On the expense side, employee benefit expenses remained the largest cost center, accounting for 69% of the expense. To the tune of scale, this cost was trimmed by 10% to Rs 37 crore. Interestingly, spending on advertising, while still relatively small, tripled to Rs 3 crore from Rs 1 crore in FY23.

Depreciation and amortization expenses fell drastically from Rs 5 crore in FY23 to just Rs 15 lakh in FY24, significantly reducing non-cash expenses. Overall, Quikr has managed to cut total costs by 11.5% to Rs 54 crore in FY24 from Rs 61 crore in the previous year.

The company’s ability to bring down operating costs along with other revenue helped Quikr to gain profitability in FY24. The Tiger Global-backed firm recorded a profit of Rs 2 crore in contrast to Rs 8 crore loss in FY23.

Its ROCE and EBITDA margin improved to 1.69% and 5.36%, respectively. Quikr spent Rs 1.20 to earn a rupee of operating revenue in FY24.

As of March 2024, the Bengaluru-based firm reported current assets of Rs 20 crore for FY24, including Rs 2 crore in cash and bank balances. This marks an 80% drop from Rs 11 crore in FY23, raising concerns about liquidity, cash flow utilization, or a potential shift in capital deployment strategy.